Introduction

Trading without indicators is like sailing without instruments. You might have intuition and experience, but without objective tools to measure direction, momentum, and strength, you’re navigating blind. Market indicators help traders make data-driven decisions rather than emotional guesses. They provide clarity in uncertain markets and structure in fast-moving environments.

Abbado’s system relies on specific, time-tested indicators that align with its rule-based framework. Unlike traders who overload their charts with unnecessary signals, Abbado focuses on a few critical metrics that enhance precision and reduce confusion. The goal is not to predict every market move but to interpret market behavior clearly and act consistently.

This article breaks down the indicators Abbado uses, why they matter, and how they integrate into your daily trading routine. By the end, you’ll understand how to use these tools effectively without overcomplicating your charts or your thinking.

Why Indicators Matter in Trading

Indicators serve one purpose: to simplify complex market data. They take raw price action—hundreds of movements per second—and translate it into patterns, signals, and insights. When used correctly, they confirm trends, identify reversals, and highlight optimal entry and exit points.

Abbado uses indicators not as standalone predictors but as confirmation tools. The system’s logic is built on convergence—when multiple indicators align to show the same signal, the probability of success increases. This approach prevents traders from acting on false moves or noise.

The right indicators can transform how you see the market. They help you recognize when to act, when to wait, and when to stay out altogether. Abbado’s strength lies in combining these signals into a consistent, rule-based framework that removes subjectivity from decision-making.

The Core Indicators Abbado Recommends

1. Moving Averages (MA)

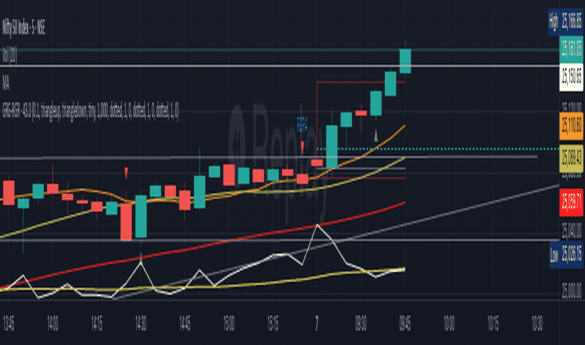

Moving averages are among the simplest and most powerful tools in trading. They smooth out price fluctuations to reveal the underlying trend. Abbado uses a combination of short-term and long-term moving averages to define trend direction and momentum.

For example, when the short-term moving average crosses above the long-term one, it signals potential bullish momentum—a buy condition in Abbado’s system. Conversely, when it crosses below, it indicates bearish pressure—a sell condition.

The advantage of moving averages is their clarity. They filter out market noise and allow traders to see the bigger picture. Abbado integrates them directly into its algorithmic structure to ensure all trades align with the prevailing market direction.

2. Relative Strength Index (RSI)

The Relative Strength Index measures the speed and magnitude of price movements, helping traders identify overbought and oversold conditions. Abbado uses RSI as a timing tool to avoid entries when markets are stretched too far in one direction.

An RSI reading above 70 often signals that the market is overbought, while a reading below 30 suggests it may be oversold. However, Abbado doesn’t treat these levels as automatic reversal signals. Instead, the system uses RSI in combination with other indicators to confirm whether momentum is sustainable or fading.

This multi-layered approach prevents premature entries and improves accuracy in volatile markets.

3. Moving Average Convergence Divergence (MACD)

The MACD combines trend and momentum analysis into one indicator. It tracks the relationship between two moving averages and generates signals based on their convergence or divergence.

Abbado relies on MACD for confirmation of trend strength. When the MACD line crosses above its signal line, it suggests momentum is building upward—supporting buy setups. When it crosses below, it indicates potential weakness—supporting sell setups.

MACD’s strength lies in its ability to filter out false trends. It gives traders insight into whether a price movement is backed by genuine momentum or just a temporary spike. Within Abbado, MACD plays a crucial role in validating entry conditions alongside moving averages and RSI.

4. Volume Analysis

Volume is the fuel that powers price movement. Without strong volume, even the best-looking chart pattern can fail. Abbado emphasizes volume analysis to confirm the strength of trends and breakouts.

When price moves are supported by increasing volume, it signals genuine interest from market participants. Conversely, weak volume during price increases often indicates fading momentum. Abbado uses real-time volume tracking to ensure trades align with the broader participation of the market.

By integrating volume filters into its trade rules, Abbado avoids low-liquidity conditions that can lead to erratic price behavior. This ensures trades occur only when the market environment supports them.

5. Average True Range (ATR)

The Average True Range measures volatility. It tells traders how much an asset typically moves within a given time frame. Abbado uses ATR to calculate position size and risk levels dynamically.

For example, when volatility is high, Abbado automatically reduces trade size to maintain consistent risk. When volatility is low, it adjusts accordingly. This flexibility allows traders to navigate different market conditions safely and confidently.

ATR doesn’t predict direction—it measures potential movement. By incorporating it into risk management, Abbado ensures that every trade maintains proportional exposure regardless of market intensity.

6. Support and Resistance Levels

While not a technical indicator in the traditional sense, support and resistance levels are vital to Abbado’s structure. These zones represent areas where the market has historically paused or reversed. Abbado’s algorithms automatically detect and update these levels, providing traders with visual clarity on where key decision points lie.

When price approaches support or resistance with confirming signals from indicators like MACD or RSI, Abbado identifies these as high-probability zones. This combination of logic and structure creates trades based on evidence rather than emotion.

The Importance of Indicator Confluence

One indicator alone can’t define a high-quality trade. Markets are too complex for single-signal decisions. That’s why Abbado’s system emphasizes confluence—the alignment of multiple indicators pointing in the same direction.

For example, a valid buy signal might require:

- Moving averages showing upward trend

- RSI confirming neutral-to-bullish momentum

- MACD supporting increasing strength

- Volume confirming participation

When all these conditions align, the system executes the trade with high confidence. This method filters out low-quality setups and creates consistency through probability rather than prediction.

Abbado’s structure ensures that each trade follows a clear logic flow. Instead of guessing, traders rely on objective alignment between multiple data points—a principle that drives professional trading success.

Avoiding the Indicator Trap

Many traders fall into what’s known as “indicator overload.” They fill their charts with so many signals that they can’t make clear decisions. This often leads to confusion, hesitation, and missed opportunities.

Abbado avoids this trap by simplifying the process. Its system uses only the most effective indicators—those that enhance decision quality, not complicate it. Each tool serves a specific purpose, and together they create balance.

The goal isn’t to have more information; it’s to have the right information. Abbado provides that clarity through a carefully tested set of indicators proven to work in combination.

Integrating Indicators into Daily Routine

Understanding indicators is one thing; using them effectively is another. Abbado’s Digital Sales Accelerator makes this seamless by embedding these tools into your daily trading workflow.

Each day, the system automatically updates indicator data and generates trade signals based on predefined logic. Traders can review setups, confirm alignment, and execute with confidence.

By standardizing indicator use, Abbado turns complex technical analysis into a simple, repeatable process. Whether you trade manually or with automation, the indicators remain your foundation for consistent, structured decisions.

How Abbado Simplifies Indicator Interpretation

Instead of showing dozens of overlapping lines, Abbado presents clean, data-driven visuals. Indicators work behind the scenes to generate simple outputs: valid signal, pending setup, or invalid condition.

This minimalistic approach allows traders to focus on execution rather than interpretation. It also reduces decision fatigue—a major factor in trading errors.

Abbado transforms technical analysis from a guessing game into a process. The indicators do the heavy lifting, and the trader executes with clarity and control.

Conclusion

Market indicators are essential tools, but their power lies in how they’re used. Abbado’s approach to indicators is built on simplicity, structure, and synergy. Rather than overwhelming traders with signals, it focuses on a select few that provide clear, reliable information.

By combining moving averages, RSI, MACD, volume, and ATR within a rule-based framework, Abbado creates a balanced view of the market. Each trade follows logic, data, and probability—not emotion.

The strength of Abbado’s indicator system is its discipline. It transforms analysis into action and uncertainty into structure. When you use these tools consistently, you stop reacting to the market and start understanding it.

In trading, clarity is power. Abbado’s recommended indicators give you that clarity, helping you make smarter, faster, and more confident decisions every time you trade.